Home » Medicare Supplement Plans

Medicare Supplement Plan Overview

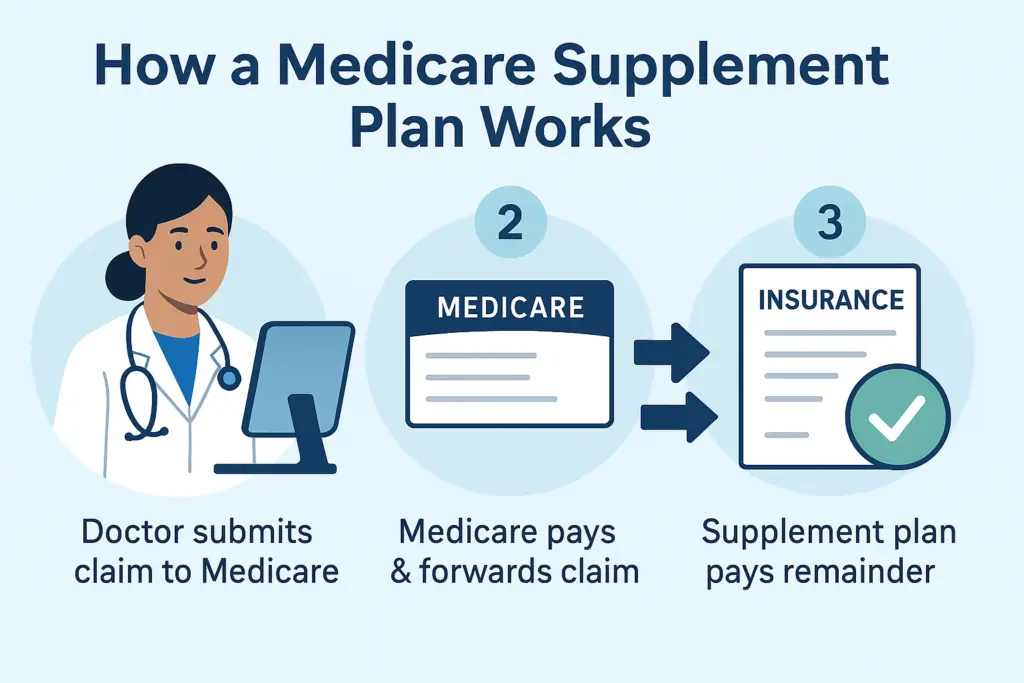

A Medicare Supplement Plan, also known as Medigap, is designed to help cover costs not paid by Original Medicare. This overview of Medicare Supplement Plans explains how they work, what they cover, and who may benefit the most.

What Is a Medicare Supplement Plan?

A Medigap Plan is a private health insurance policy that helps pay for expenses not covered by Medicare Part A and Part B. These expenses may include coinsurance, copayments, and deductibles.

Unlike Medicare Advantage plans, which replace Original Medicare, Medigap works alongside it. You must remain enrolled in both Medicare Part A and Part B to buy and keep a Medigap plan.

Why Consider a Medigap Plan?

Medigap Plans offer financial protection from unexpected medical costs. They also provide consistent coverage and access to any doctor or hospital that accepts Medicare nationwide.

Benefits of a Medigap Plan:

Helps pay out-of-pocket costs left by Original Medicare

No provider networks — see any doctor who accepts Medicare

Coverage that stays the same year to year

Guaranteed renewability — your policy can’t be canceled if you pay your premium

What Do Medicare Supplement Plans Cover?

Each Medicare Supplement Plan is standardized and labeled with a letter (such as Plan G or Plan N). All plans must cover certain basic benefits, and some cover more depending on the plan you choose.

Standard Medigap Coverage Includes:

Medicare Part A coinsurance and hospital costs

Medicare Part B coinsurance or copayments

First 3 pints of blood used in a medical procedure

Part A hospice care coinsurance or copayment

Some plans also cover:

Skilled nursing facility coinsurance

Medicare Part A and/or Part B deductibles

Foreign travel emergency care (up to plan limits)

Plan G is currently one of the most comprehensive Medigap plans available for new enrollees.

What Is Not Covered by a Medigap Plan?

Medicare Supplement Plans do not cover:

Long-term care

Vision or dental services

Hearing aids

Private-duty nursing

Prescription drugs

You must enroll in a standalone Medicare Part D plan to get drug coverage.

How Much Do Medigap Plans Cost?

The cost of a Medicare Supplement Plan depends on several factors:

The plan you choose (Plan G, Plan N, etc.)

Your age and ZIP code

Whether you use tobacco

Pricing method used by the insurer (community-rated, issue-age-rated, or attained-age-rated)

Although premiums may be higher than Medicare Advantage plans, many beneficiaries value the stability and flexibility Medigap offers.

When Should You Enroll in a Medigap Plan?

The best time to enroll in a Medicare Supplement Plan is during your Medigap Open Enrollment Period. This is the six-month period that begins when you are both 65 or older and enrolled in Medicare Part B.

During this period:

You cannot be denied coverage for health reasons

You’ll get the best rates available

You won’t need to answer medical questions

If you apply later, you may be subject to underwriting and could be denied coverage or charged more.

Can You Have a Medicare Advantage and Medicare Supplement Plan?

No. You must choose between a Medicare Supplement Plan and a Medicare Advantage Plan. You cannot be enrolled in both at the same time.

How Do You Choose the Right Medicare Supplement Plan?

When comparing Medicare Supplement Plans, consider the following:

Your current and expected medical needs

Your budget for monthly premiums

Whether you travel frequently

Whether you want full coverage or are comfortable paying small copays

Use a Medigap comparison chart or speak with a licensed Medicare advisor to find the right fit.

Is a Medicare Supplement Plan Right for You?

A Medicare Supplement Plan may be right for you if:

You want to avoid high out-of-pocket costs

You travel within the U.S. and need broad access to providers

You want stable, predictable health coverage

If you prefer an all-in-one plan with extras like dental or vision, you may want to compare it to a Medicare Advantage plan.

Conclusion: Medicare Supplement Plans Provide Peace of Mind

This overview of Medicare Supplement Plans shows that Medigap can be a valuable part of your retirement health care strategy. By filling the gaps in Original Medicare, these plans offer predictable costs and reliable access to care.

Supplement Rate Comparison

Thousands of Satisfied Customers