Home » medicare-prescription-plans

Understanding Medicare Prescription Drug Plans

If you’re enrolled in Medicare, choosing the right Medicare prescription drug plan is essential to help manage the cost of your medications. These plans, also known as Medicare Part D, are offered by private insurance companies approved by Medicare and are designed to help cover the cost of both brand-name and generic prescription drugs.

What Are Medicare Prescription Drug Plans?

Medicare prescription drug plans provide coverage for outpatient prescription medications. These plans are available to anyone with Medicare Part A and/or Part B and are optional—but without coverage, you could face late enrollment penalties.

Types of Part D Coverage

There are two ways to get Medicare prescription drug coverage:

Standalone Part D plans: Work alongside Original Medicare.

Medicare Advantage plans (Part C) with drug coverage: Offer all-in-one plans, including hospital, medical, and drug benefits.

How Do Plans Work?

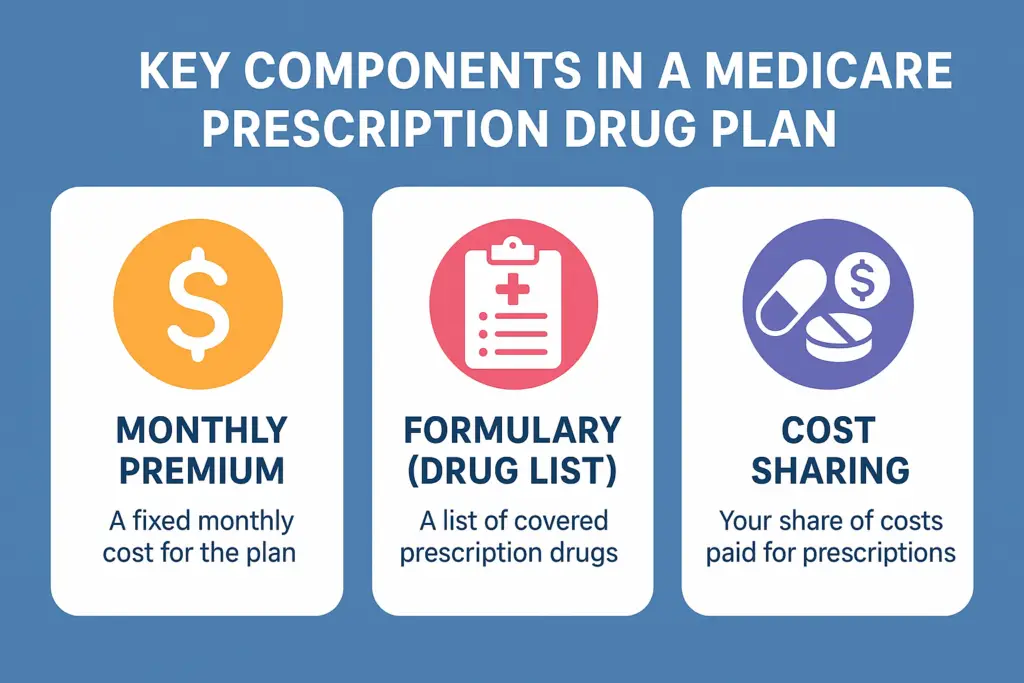

Each Medicare drug plan has a formulary—a list of covered medications. The formulary is usually organized into tiers. Lower-tier drugs generally cost less than higher-tier drugs. Plans may vary, so comparing formularies is key.

What Do Medicare Prescription Drug Plans Cover?

Most plans cover both brand-name and generic drugs.

Coverage includes medications for chronic conditions, short-term illnesses, and preventive treatments.

Plans must cover at least two drugs in each therapeutic category, but coverage details can vary. It’s crucial to ensure your specific medications are included in the plan’s formulary.

What Is the Cost of Medicare Drug Coverage?

Costs for Medicare prescription drug plans include:

Monthly premium: Varies by plan and location.

Annual deductible: Not all plans have one, but Medicare sets a maximum amount each year.

Copayments and coinsurance: Your share of the drug cost.

Coverage gap (donut hole): Temporary limit on what the plan covers for drugs.

After you and your plan spend a certain amount, you may enter the coverage gap. You’ll pay a percentage of drug costs until you reach the catastrophic coverage phase.

How to Choose a Medicare Prescription Drug Plan

Choosing the best Medicare prescription drug plan depends on several factors:

Your current medications

Preferred pharmacy network

Monthly budget

Whether you travel or live in multiple states

Use the Medicare Plan Finder tool at medicare.gov or consult with a licensed agent to compare your options.

When Can You Enroll in a Medicare Drug Plan?

You can enroll in a Medicare prescription drug plan during the following periods:

Initial Enrollment Period (IEP): When you first become eligible for Medicare.

Annual Enrollment Period (AEP): October 15 – December 7.

Special Enrollment Period (SEP): Triggered by life events such as moving or losing other insurance coverage.

Missing the deadline may result in a late enrollment penalty, which adds to your monthly premium.

Do You Need a Medicare Prescription Drug Plan?

If you take any prescription medications—even occasionally—it’s smart to consider enrolling in a Part D plan. Without coverage, you risk high out-of-pocket costs and penalties later on.

Even if you’re not currently on medications, having a basic Medicare drug plan can protect you from future costs and secure access to necessary prescriptions.

Final Thoughts on Medicare Prescription Drug Plans

Medicare prescription drug plans play a vital role in helping you afford your medications and maintain your health. Comparing coverage, understanding your options, and enrolling on time can save you money and provide peace of mind.

If you’re not sure where to begin, the Medicare Guidance Center is your trusted resource for help navigating Part D coverage. We’ll help you review your prescriptions, compare plans, and find the best option for your needs.

.

Prescription Plan Comparison

Thousands of Satisfied Customers